A new online advice service has been launched that is already helping those that have succumbed to temptation and taken out a PayDay loan. Money Nerd has a wealth of advice for those looking to avoid the high interest and extortionate charges, with more loopholes promised if visitors sign up to the free newsletter.

What is a Pay Day Loan?

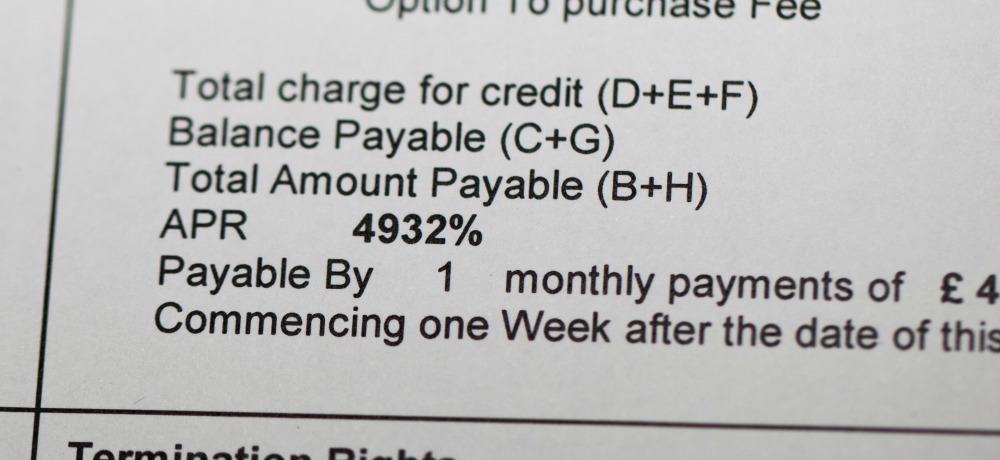

A Pay Day Loan is a high interest loan given to people who are short of cash before pay day. People with bad credit often qualify for a short term loan of this type, as the interest rates are high which protects the lender from non payment. Many people take out pay day loans to cover unexpected expenses such as a broken boiler or car trouble. They are not recommended for funding holidays, home improvements or new businesses. If a borrower pays off the payday loan within a couple of weeks (as recommended), the charges aren’t too high. Trouble ensues when the pay day loan rolls on indefinitely incurring interest of over 1000%. Many people with bad credit have found themselves further in financial hardship due to the interest payments and the trap that is the pay day loan culture. Here at The Consumer Voice we urge you to seek alternatives, such as a tax refund on tools, uniforms or travel, to a pay day loan to finance hidden expenses.

What is Money Nerd?

Money Nerd is a free advice website for those who have taken out a Pay Day loan. It provides information and help to those struggling to pay back a Pay Day loan, along with those who are caught in the Pay Day loan trap. Covering all legal angles, Money Nerd reveals ways in which borrowers can cut down or eliminate the interest they pay on a short term loan, making it a resourceful, essential guide for those considering, enduring, or paying back a loan of this type.

What Advice Does Money Nerd Give?

To see all of the advice from Money Nerd, you should visit their website. There you will find interesting topics such as:

- Ways to Pay Off a PayDay Loan Quickly

- The Best Loans (detailing the best interest rates) – A Guide to Loan Alternatives

- Different Debt Collection Agencies – Loopholes to Avoid Payment – This is actually our favourite part so far as it names and shames many debt colkection agencies from the Lewis Group to FredPay. It details the tactics they use and the loopholes you can utilise to minimise the amount you pay or to avoid paying at all. This section also demonstrates your rights and responsibilities and bully tactics you should not be intimidated by.

Who Is Behind Money Nerd?

A man called John is the brains behind Money Nerd. He has empathy with victims of PayDay loan interest as he spent five full years avoiding debt collection agencies. His story is an inspiration, as, after learning about the law surrounding PayDay loans, he didn’t pay back a penny. He wants others to enjoy the same outcome, and is regularly sharing every tip and legal loophole to ensure you can say goodbye to debt collection agencies for good.

Every 6 minutes a bankruptcy is declared, while the average house pays £1899 of interest per year. These figures show that we need someone like John, the Money Nerd to help those who have fallen victim to high interest charges through dubious PayDay loans.

Money Nerd has been reviewed and approved by The Consumer Voice and we highly recommend it as a source of PayDay loan advice.

The Consumer Voice Real Reviews, eCommerce News and FREE Customer Advice

The Consumer Voice Real Reviews, eCommerce News and FREE Customer Advice